Ipko Biznes

Ipko Biznes Choose a mid-tier bundle if your team processes 300+ domestic transfers per month; pick an entry option for ≤100 transfers, solo user access, basic statements. Firms with payroll, FX hedging, API needs should target an upper tier with unlimited local transfers, SEPA/SWIFT support, role-based controls, SSO. Aim for a total bank fee below 0.1% of monthly payment volume, plus cut approval time by enforcing a four-eyes flow.

Use clear cost targets: base fee capped by expected automation gains, per-transfer fee near zero on domestic rails, FX margin below 0.35%, card maintenance trimmed via volume bundles. Ask pkobp for a written tariff grid with volume breaks, SLA figures, escalation paths. Verify all numbers inside ipko after secure logowanie, then match the grid to your payment profile: domestic batches per cycle, SEPA volume, payroll windows, FX pairs, cash needs.

Secure access first. Enforce MFA for every user via password plus token code or mobile approval inside ipko. Map roles by duty: preparer, reviewer, approver, auditor. Set per-user limits for single transfer, daily total, FX deals. Enable SSO via SAML or OIDC if available, plus IP restrictions for finance workstations.

Onboarding checklist: company data verification, beneficiary import, payment templates, statement formats (MT940, CAMT.053), API keys, webhooks, alert rules. Run two dry runs: one domestic batch, one SEPA batch, with dual approval, then reconcile exports inside your ERP. Log outcomes, fix mismatches, repeat until zero variances.

For pko or bp clients, request a trial month with a waived base fee tied to measurable usage goals. Track weekly metrics: login failures, token desync cases, API latency p95, rejected transfers ratio, cut-off adherence. If thresholds slip, trigger the pkobp escalation path listed in the SLA, plus capture evidence for fee reviews.

Ipko Biznes - Plans Pricing, Setup, and Features for PKO BP (PKOBP) – PKO, iPKO logowanie, and iPKO Biznes logowanie

Ipko Biznes pick the firm-oriented online channel from pkobp with dual approval for payouts, require mobile token for every transfer above 5,000 PLN, cap each user at a level matching role risk, use SEPA for EUR to cut costs, reserve instant transfers for urgent cases, add PLN plus EUR subaccounts, export MT940 daily for your ERP, import pain.001 for batches, review rights monthly.

Costs, limits, channels at pkobp

Domestic ELIXIR via web often free after meeting volume or balance targets; otherwise a small fee per transfer applies. Instant transfer carries a premium; use only for time-critical moves. SEPA for EUR typically low; SWIFT for other currencies includes bank fee plus lifting fee at the beneficiary side. Card fee usually waived after a monthly spend threshold; ATM cash withdrawal can trigger extra cost. Negotiate a bundle that matches your transfer count, foreign currency needs, cash operations; push for waiver based on turnover or deposit size.

Set limits: daily cap per user tied to role, per transfer cap for new beneficiaries, separate cap for payroll, tax, supplier batches. Enable white list for trusted IBANs; block payouts to new IBANs until a cooling period passes. Schedule statement export at 06:30 plus 15:30 so accounting posts early; keep a month-end extra export. For bulk activity, request dedicated connectivity from pkobp for file exchange with SFTP or API, then map pain.001, camt.053, MT940 in your ERP.

Activation, roles, integration

Prepare documents: NIP, REGON, KRS or CEIDG extract, IDs for signatories, UBO declaration, board resolution for representation rules. After activation, create an admin profile separate from payment users; define maker, checker, releaser, viewer; apply 4-eyes for supplier payouts above 20,000 PLN, 2-of-2 for payroll, single signer for low-value tax. Configure cut-off awareness: submit local transfers before the bank’s last ELIXIR session; use SEPA D+1 for non-urgent EUR, express rails only if a deadline cannot slip.

ipko logowanie: access via pkobp.pl or ipko.pl only; verify the certificate in the browser; never follow email links. Use mobile token as the default second factor; keep SMS codes as backup only. Enforce lock after 5 failed attempts; enable alert for logowanie from a new device or unusual location; restrict admin access by office IP range. Rotate passwords every 90 days, minimum 12 characters with passphrase style; disable dormant users after 30 days without activity.

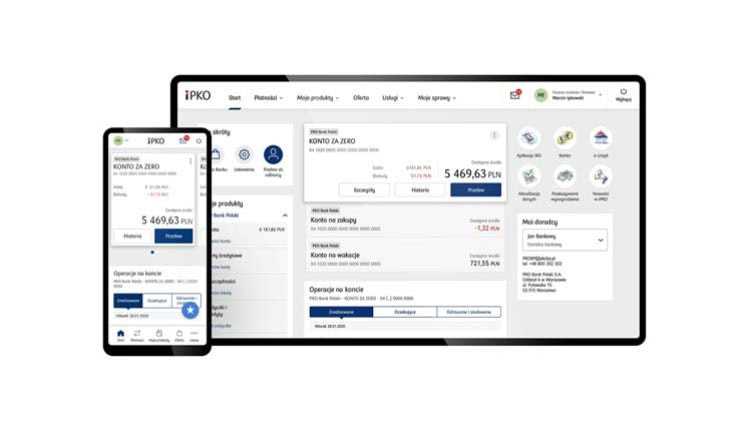

For mobile, install the ipko biznes app from official stores; pair the token during a branch visit or via a secure activation code; require biometric unlock on each approval; disable screenshots on managed devices. For audit, export event logs weekly; archive approval trails with payment files; reconcile MT940 or camt.053 totals with ERP ledgers daily; fix breaks the same day.

Cash management tips: collect EUR to a EUR account to avoid conversion; use internal transfers between your PLN plus FX accounts for same-day value; group supplier payouts into batches to cut unit fees; prefer SEPA over SWIFT for the Eurozone; set value date D+1 for non-urgent flows to reduce charges.

Support flow: create two contacts at pkobp, one for online channel matters, one for cards; note the hotline for lockouts; keep a recovery procedure that includes user suspension, token reset, role review, password refresh for all users after a suspected incident.

IPKO Business plan tiers: monthly pricing, included transfers, and add-on modules

Select a tier by real monthly volume: Solo, up to 30 domestic ELIXIR; Team, 31–150; High-volume, 151+. Target per-month budget: PLN 15–25, 40–70, 90–150 respectively; typical overage per extra domestic transfer: PLN 0.50–1.50, 0.30–1.00, 0.20–0.80. Include SEPA: 2–5, 5–15, 20+; SWIFT from mid level. Add 20% headroom to avoid frequent overage.

Extras to activate: Payroll for 10+ salaries, Mass payouts for marketplaces or platforms, API plus SFTP for ERP links, multiuser approval flow with maker–checker–releaser, mobile approvals, push alerts, FX module with spot or forward coverage, virtual accounts, cash pooling.

Access, security: ipko biznes portal, logowanie via mobile signature, hardware token, biometric; SSO optional; role matrix with limits per user, per account; IP allowlist; 2FA; audit trail retention 12–24 months; daily payment cut-offs visible in the dashboard.

Cost control tips: pick a bundle that covers average volume plus 20%, batch domestic payments to lower overage, prefer SEPA where IBAN permits, schedule FX during core hours for tighter spreads, switch recurring suppliers to regular orders, review monthly statement for idle extras.

Integration path: ERP or accounting via REST API, file gateways (XML, CSV), KSeF e-invoicing connector, card settlement files, webhook callbacks for status updates. For terms or bespoke rates contact pkobp via pkobp.pl, reference ipko biznes, include company NIP plus bp segment, share expected monthly volumes.

Tariffs may vary by contract with pkobp, verify current tables on pkobp.pl before activation.

New company onboarding in iPKO Biznes: registration, identity verification, and activation timeline

Submit the application before 12:00 CET to reach same-day review, prepare a KRS extract (≤30 days), NIP, REGON, UBO list, IDs for representatives, plus a board resolution authorizing account opening with ipko channel access.

Registration path

Step 1 – Start: go to pkobp or pko portal for firms, choose corporate account with ipko access, select legal form (KRS or CEIDG), declare expected turnover, cash operations, foreign transfers, FATCA/CRS status, PEP exposure.

Step 2 – Representatives: list persons with authority, provide PESEL or passport data, role (administrator, signer), specimen signature or qualified e-signature preference, contact emails for logowanie setup.

Step 3 – Documents: attach KRS/CEIDG printout, Articles of Association or partnership deed, UBO declaration per AML, ID copies, VAT status if relevant, sanction/PEP statements. For non-Polish entities: notarized copies with apostille plus sworn translations.

Step 4 – Signing method: choose qualified electronic signature, ePUAP trusted profile, branch visit, or courier verification. Remote route shortens activation for domestic entities; foreign structures often require branch or courier.

Step 5 – Access provisioning: define authorization scheme (single or dual control), per-user limits, allowed channels, mobile authorization for ipko, optional IP whitelisting. Administrator receives initial credentials for first logowanie.

Identity verification specifics

Domestic companies: verification uses KRS/CEIDG data, UBO screening, sanction lists, risk scoring based on PKD, geography, cash volume. Foreign ownership or high-risk PKD triggers extended checks. Video verification may be offered case-by-case; courier or branch remains default for complex cases.

After agreement signing, the bank issues user IDs, temporary passwords or activation links, plus a mobile authorization prompt. First logowanie requires password change, activation of the mobile application for ipko, confirmation via SMS or push, then optional token deactivation if mobile approval is enabled.

| Stage | What happens | Typical time | Speed tips |

|---|---|---|---|

| Online form | Data entry, product choice, contact details | 15–25 minutes | Use KRS/CEIDG auto-fill, prepare PDFs |

| KYC review | UBO, PEP, sanction checks, risk scoring | 0.5–2 business days (PL) • 3–7 (foreign) | Fresh KRS (≤30 days), complete UBO data, clear ownership chart |

| Agreement signing | Qualified e-signature, ePUAP, branch, or courier | Minutes (e-sign) • same day (branch) • 1–2 days (courier) | Choose e-sign for fastest result |

| Channel provisioning | User IDs, temporary credentials, mobile authorization | Up to 4 hours after signing | Nominate one administrator, enable mobile approval |

| First logowanie | Password change, device pairing, limits check | 10–20 minutes | Have phone ready, confirm push promptly |

| Go live | First transfer, card ordering, statement settings | Same day if submitted before 12:00 CET | Load beneficiary list, set templates, enable alerts |

Security hygiene: enforce dual control for payments over your threshold, activate alerts for logowanie, changes to beneficiaries, failed approvals; restrict high-risk countries; review limits monthly; audit user roles quarterly.

Common blockers: mismatch between KRS data and Articles, missing UBO declaration, outdated IDs, unclear ownership for multi-layer structures, unresolved PEP disclosures, non-apostilled foreign documents. Resolve these upfront to keep the timeline tight.

Support channels: corporate hotline for pkobp clients, branch relationship managers for complex ownership, dedicated onboarding teams for high-volume biznes clients requiring tailored limits or cash services.

User access in iPKO Biznes: creating profiles, roles, approval chains, and authorization tools

Create named profiles only, forbid shared credentials, enable strong 2FA for every user.

Profiles, roles, least privilege

1) In ipko for biznes open Administration, add a new user profile, assign a unique login for logowanie, require a long password, enforce rotation every 60–90 days.

2) Capture identity data that your policy requires, set mobile number for codes, email for alerts, bind a device or token during first logowanie.

3) Assign minimal rights by role: Viewer (read-only), Initiator (creates orders, no release), Approver (authorizes), Administrator (manages users, rights, limits). Keep Initiator separate from Approver, apply the four-eyes rule.

4) Restrict scope via account groups, product modules you actually use: domestic transfers, tax to US/ZUS, SEPA, SWIFT, payroll, cards, FX. Disable modules not used.

5) Set monetary limits per user: per-transaction, daily, monthly, currency-specific. Use lower limits for routine ops, reserve higher caps for senior approvers.

6) Add at least two Administrators per legal entity to avoid lockout, schedule quarterly access recertification, remove dormant profiles within 30 days.

Approval chains, authorization tools

Build a matrix by amount, channel, currency. Example policy: PLN 0–50k: 1 Approver, PLN 50k–1m: 2 Approvers, above 1m: 3 Approvers. Foreign or urgent SWIFT: +1 extra Approver. Payroll: separate route, release only within payroll window.

Choose an authorization method per risk level: SMS codes for low-value tasks, mobile token in the corporate app for medium value, hardware token or qualified signature for high value. Require step-up for new beneficiaries, cross-border transfers, template changes.

Strengthen logowanie: IP or device trust lists if available, geofencing alerts, session timeout 5–10 minutes, automatic logout on inactivity, alert on first login from a new device.

Operational hygiene: daily review of the event log, export monthly audit trails, dual control for beneficiary master data, maker–checker for limits, change freezes during critical periods such as VAT, ZUS, payroll cutoffs.

Support contact location, product scope, security rules for pko bp corporate channels reside on the official site: https://www.pkobp.pl/korporacje/.

Keywords: pko, ipko, biznes, logowanie, bp.

Payments setup in iPKO: domestic Elixir/SORBNET, SEPA/SWIFT, standing orders, and bulk files

Use Elixir for routine PLN moves, switch to SORBNET for high value or time-critical transfers, pick SEPA for EUR within the SEPA zone, select SWIFT for other currencies. Enforce maker-checker for every rail.

- Access: logowanie via ipko biznes portal by pkobp, token or mobile authorization, IP whitelisting, session timeout set to short interval.

- Roles: Creator, Verifier, Final approver, emergency approver with narrow limits only.

- Limits: per user, per rail, per currency, per counterparty, per day, per month.

- Notifications: push, SMS, email on creation, approval, rejection, execution, return.

Domestic PLN – Elixir vs SORBNET

- Elixir: three clearing windows on banking days. Target same-day credit for files released before the last window. Safer rule: submit before 14:00 local time.

- SORBNET: real-time gross during NBP hours, use for amounts ≥ 1,000,000 PLN or deals with strict deadlines. Final bank cut-off usually late afternoon.

- Split payment (MPP): for VAT invoices tick MPP, provide invoice number, supplier VAT account. The system routes net to main account, VAT to sub-account.

- Domestic structured transfers: ZUS, US. Use dedicated forms, fill NIP/PESEL, period, symbol, avoid free-text fields.

- Counterparty format: NRB 26 digits, validate checksum, store alias, require second approval on first use.

SEPA (EUR)

- IBAN required, BIC optional for SCT. Charges type SHA only. EUR only, cross-border within SEPA area.

- Execution D+1 per rulebook. For faster delivery, release before early afternoon. Remittance up to 140 chars, Latin set only.

- Reject causes: invalid IBAN, non-EUR, forbidden charges type, long remittance, sanctions hit. Enable auto-alerts on R-messages.

SWIFT (FX or non-SEPA)

- Input IBAN or account number as per country, BIC mandatory. Intermediary BIC optional, useful for exotic corridors.

- Charges: OUR, SHA, BEN per contract. For full-amount guarantees use OUR, expect correspondent fees.

- Provide purpose of payment codes where required, include invoice, contract, HS code for customs-related wires.

- FX: choose deal reference or on-the-spot. Lock rate before release for large wires, set tolerance, auto-cancel if tolerance breached.

Standing orders

- Frequency: daily, weekly, monthly, specific weekdays, business-day shift rules (preceding, following).

- Start date, optional end date, skip on holidays or shift per rule. Partial execution disabled by default.

- Indexation: optional fixed uplift per period, cap, floor. Use for rent, leases.

- Monitoring: stop after N failures, alert creator, log reason, auto-retry next cycle.

Bulk files

- Formats: ISO 20022 pain.001.001.03 (preferred), CSV per pkobp layout. For collections use pain.008, for reports use camt.053 or MT940 (separate module).

- Channels: portal upload, SFTP, webservice API by pkobp. Use PGP encryption, mutual TLS, file-level signing.

- Validation: schema check, duplicate control via MessageId, BatchId, EndToEndId, amount, beneficiary tuple. Reject duplicates, allow resubmission with new IDs.

- Batch controls: per-rail routing inside one file via service level tags – SEPA, URGP for SORBNET, STD for Elixir, INTL for SWIFT. Split by currency automatically.

- Authorizations: one file, many items, approvals applied per batch total, optional per item for high-risk payees.

- Cut-offs: file acceptance up to bank deadlines per rail. Place timers to send earlier than the last window.

Risk controls

- Whitelist trusted beneficiaries, require two approvals for first payment, reduce to one for repeats within limit.

- Velocity rules per user, block unusual spikes, alert on new country, new currency, late-day SORBNET over threshold.

- Audit: immutable logs, export to SIEM, retain for regulatory period.

Reconciliation tips

- Populate EndToEndId with invoice number or ERP key, unique per item. Mirror in statement matching rules.

- Request camt.054 for intraday credits, speed up posting in ERP.

Quick checklist

- Complete logowanie policies for ipko biznes, enforce 2FA, short sessions, IP control.

- Define roles, limits, approval matrix per rail, currency, amount.

- Create beneficiary library with NRB, IBAN, BIC, MPP flags, tax templates.

- Enable SEPA, SORBNET, SWIFT in contract with pkobp, verify fees, cut-offs, file limits with bp support.

- Test pain.001 on UAT, validate routing tags, verify duplicate rules, confirm statement IDs.

- Schedule Elixir before early afternoon, SORBNET before final window, SEPA before D+1 cut-off.

PKO BP logowanie and iPKO logowanie: login options, 2FA methods, password reset, and common error fixes

Use only official portals for logowanie: https://www.ipko.pl/ or https://www.pkobp.pl/, verify the padlock, certificate issued to pko Bank Polski.

Login options

- Web portal (ipko): click Zaloguj, enter NIK/login plus password, confirm using a second factor. On shared devices use the virtual keyboard, avoid password saving.

- Mobile (IKO): open the app, confirm with PIN or biometric. First activation: install from official stores, run activation with client number, SMS code, then set a PIN.

- Shortcut via QR: from ipko choose IKO pairing, scan the QR with the app, finish inside IKO.

2FA methods, security

- Push in IKO: receive a prompt with payee, amount, account, validate details, confirm with PIN or biometric.

- SMS code: one-time code to the registered number, keep the number up to date in ipko, never share the code.

- Choice of default method: in ipko settings pick push or SMS, set transaction limits per channel.

- Device trust: mark a private browser as trusted to reduce prompts for low-risk login, keep 2FA for payments.

Password reset (Nie pamiętam hasła):

- Go to https://www.ipko.pl/ → Nie pamiętam hasła.

- Provide NIK/login, personal data (e.g., PESEL), last digits of card or account as requested, confirm via SMS or IKO push.

- Create a new password, then review trusted devices in ipko, remove unknown sessions.

Common error fixes:

- Wrong credentials: check CAPS LOCK, keyboard layout, avoid spaces, use the login mask hint if shown.

- Account lock after failed attempts: wait for auto-unlock or verify identity via hotline listed in the portal, do not retry blindly.

- No SMS codes: confirm roaming, signal, correct time on the phone, clear blocked senders, switch to IKO push as fallback.

- Browser issues (403/500, blank page): use a current version of Chrome, Edge, Firefox, Safari, enable cookies, clear cache, disable extensions that inject scripts, try Incognito.

- Phishing signs: domain different from ipko.pl or pkobp.pl, mixed-content warnings, typos. Close the tab, report via secure message in ipko.

- Session timeout: log in again, avoid multiple tabs with active forms.

- Security code mismatch in push: cancel in IKO, reinitiate the operation from ipko.

Hardening tips:

- Password policy: at least 12 characters, letters, digits, symbols, unique per service, rotate if exposed.

- Notifications: enable login alerts via IKO push or SMS, monitor unexpected activity.

- Limits: set daily transfer caps, require 2FA for templates, verify beneficiary data on each push prompt.

- Lost phone: unpair IKO in ipko, change password, ask the carrier to block the SIM.

- Always start from bookmarks to ipko.pkobp.pl or ipko.pl, avoid links in messages.

Brand keywords for clarity: pko, pkobp, bp, ipko, logowanie.

Connecting iPKO with accounting and ERP: API availability, file formats, and automation rules

Choose the corporate API from pkobp for bulk ERP flows; use PSD2 only for read-only balance queries or single-payment scenarios to minimize consent churn.

API options, auth, environments

PSD2: AIS/PIS via OAuth2 with SCA triggered through logowanie in the ipko portal. Consent lifetime typically 90–180 days, scope-bound to selected accounts. Expect per-application rate limits, plus daily call caps per consent. Use token cache with auto-refresh, monitor 401/403 for consent expiry, trigger user re-consent via a deep link to ipko when needed.

Corporate channel from pkobp: mutual TLS with client certificates, IP allowlist, technical users separate from human operators. Batch payment submission, status retrieval via pull or callback, multi-signature flows supported in the ipko biznes UI. For SWIFT connectivity, enable MT101 via SCORE or MA-CUG if your ERP prefers that route.

Non-prod use: request a sandbox from pkobp, mirror message schemas in UAT, keep certificate sets per environment, isolate webhooks by environment-specific URLs.

Formats, transport, automation rules

Outgoing payments: SEPA XML pain.001.001.03 for EUR, domestic PLN (ELIXIR) via the bank’s pain.001 profile with NRB support, high-value PLN via SORBNET2 using dedicated service codes, FX or SWIFT cross-border via pain.001 with BIC/charge options or MT101. Status: pain.002 for file-level or transaction-level feedback, camt.054 for booking notifications.

Account reporting: camt.053 for end-of-day, camt.052 for intraday, camt.054 for credits such as payouts or card settlements. Legacy: MT940/942 remains available. CSV export from ipko biznes can serve as a fallback; lock delimiter, decimal mark, timezone (CET/CEST) in your parser to avoid reconciliation drift.

Transport: API over TLS 1.2+, SFTP with PGP encryption for files, SWIFT for MT messages. Enforce PGP 4096-bit keys, rotate keys yearly, rotate client certificates before expiry, store fingerprints in a secure registry.

Cut-offs in PL: plan ELIXIR submissions before bank-specific deadlines prior to KIR sessions (~09:30, ~13:30, ~16:00 CET). For SEPA same-day, target early afternoon; for urgent PLN, route via SORBNET2. Queue logic should auto-reroute late files to next cycle or a real-time rail where available.

Idempotency: generate unique MessageId per file, unique EndToEndId per transaction, persist a hash of each payload. On retries, resend with the same identifiers to avoid duplicates. For SWIFT, keep UETR for trace.

Reconciliation rules: primary match by IBAN/NRB + amount + value date; secondary by EndToEndId or virtual account; tertiary by payment title (tytuł). Vendor match via IBAN first, then NIP or KRS where present. Auto-close residuals below a defined threshold, push exceptions to a review queue.

Approvals & segregation: enforce four-eyes for payment files at ipko biznes level, keep technical users without approval rights, restrict entitlements per company code. Use webhooks or polling only from a dedicated integration subnet.

Error handling: exponential backoff on 5xx or network timeouts, circuit-breaker after N failures, alert on schema rejects (pain.002 negative), auto-retry on “processing” until final status arrives or SLA expires. For PSD2, watch for consent scope mismatches after role changes in ipko.

ERP mapping tips: normalize creditor/debtor names to 70 chars for SEPA, cleanse diacritics where schemas require. Map charge option (SHA/OUR/BEN) for cross-border. Persist exchange rate, booking date, bank reference, fee lines from camt.054 to support JPK reports in PL.

Security & audit: mask IBAN in logs (keep last 4), sign outbound files, verify inbound signatures, archive statements for at least 5 years, keep an audit trail with user, timestamp, source IP, file hash. Test disaster recovery: SFTP fallback to API, API fallback to manual import via ipko biznes UI.

Quick checklist: pick channel (PSD2 vs corporate API) per use case, lock file schemas (pain/camt/MT) with versions, set cut-offs by rail, implement idempotency, plan consent renewals tied to logowanie flows, verify access with pkobp before go-live, document every integration step for pko support.